Here it means the price should not close below (uptrend) / above (downtrend) 0.618 retracement line. The basis of this strategy is the use of two traditional tools which are zigzag and fibonacci.

? Forex Signals Review May 2631 ? Fibonacci Forex

? Forex Signals Review May 2631 ? Fibonacci Forex

The price must touch 5 wma.

Fibonacci forex trading strategy. As we know, fibonacci is everywhere and there are many real examples of the golden ratio in nature. A fibonacci strategy for day trading forex uses a series of numbers, ratios and patterns to establish entry and exit points. If you don't have the basics down, please go read the main article first.

Fibonacci is one of the easiest forms of technical analysis to grasp which is why today i will show you a fibonacci forex strategy. When a stock is trending in one direction, some believe that there will be a pullback, or decline in prices. Within a fibonacci trading strategy, traders can go one step further and add in more technical analysis to help confirm whether the market will actually turn or not.

Profitable trading strategies are usually extremely simple. Therefore, traders believe that the 68.1% retracement and 161.8 extensions may give better accuracy compared to the other price prediction methods. Folks, i want to bring on here a very simple strategy.

In these two examples, we see that price found some temporary forex support or resistance at fibonacci retracement levels. A forex fibonacci trading strategy. Zigzag just helps to identify the swings but any trader should be able to identify the swings with the naked.

We have already established that the price of a market can often turn, or find support or resistance, at different fibonacci levels. Fibonacci extensions can compliment this strategy by giving traders fibonacci based profit targets. What is the fibonacci trading strategy?

The price must at least touch 0.382 fibonacci retracement level. If enough market participants believe. It’s a professional forex trading strategy known by few, which is untold.

Leonardo pisano, nicknamed fibonacci, was an italian mathematician born in pisa in 1170. Fibonacci has become a powerful tool in forex and other cfd trading. As with any tool we use though, it is very important to understand what it is, what it does, and how to use it in trades before ever adding it to your trading strategy.

This type of trading is highly contested as it is based on ratios that don. If you have traded forex long enough, you will notice that sometimes, price has an uncanny ability to reverse exactly at or around fibonacci levels. It is recommended to wait until these bounces stop and open new positions only after the market direction is determined.

A profitable fibonacci retracement trading strategy this bonus report was written to compliment my article, how to use fibonacci retracement and extension levels. In the foreign exchange market, the price trends of currency pairs can be tracked via used strategies based on the series. Three simple fibonacci strategies used in forex trading are:

This setup is ideal for day trading. In the stock market, the fibonacci trading strategy traces trends in stocks. The value from one swing point to another.

If you had some orders either at the 38.2% or 50.0% levels, you would’ve made some mad pips on that trade. These levels are calculated relative to the size of the previous move i.e. The fibonacci forex trading strategy with reversal candlesticks is simply about using fibonacci retracement in conjunction with reversal candlesticks.

It can also be used on any time frame. Drag zigzag indicator on the chart and leave default settings for now. Fibonacci traders contend a pullback will happen at the fibonacci retracement levels of 23.6%, 38.2%, 61.8%, or 76.4%.

The last part of this course is dedicated to the forex trading strategy with fibonacci clusters, also we are going to apply everything we have learned during the course in live trading examples. During the retracement there are three conditions to be met in order to consider trading: Trading tools for fibonacci trend line trading strategy 1.

The idea is to wait for setups where obvious support or resistance (previous market The fibonacci trading strategy uses the golden ratio to determine entry and exit points for trades of all time frames. Fibonacci levels are used in trading financial assets such as forex, cryptocurrencies, stocks, futures, commodities and more.

The 0.618 fibonacci retracement level must not fail. First, draw a fibonacci for the previous day’s lowest and highest market values. Fibonacci extensions consist of levels drawn beyond the standard 100% level and can be used by.

Any fibonacci forex trading strategy for the market trade shall consider that in the zone close to fibo levels speculative price bounces can possibly happen in case of a sharp breakdown. We’ll explain how to use fibonacci retracement levels and extensions to identify support and resistance areas, plus profit taking targets. From forex traders to institutions, fibonacci is a mainstay of market analysis, and an important tool when trading or investing in stocks.

This trading system is based on the “fibonacci fan” to identify. In the event of a pair trending in a unidirectional fashion, a few traders forecast a fall in value or a price pullback. I will show you how to analyze currency pairs, how to setup the trade, how to setup stop loss and take profit, money management and results after each.

This is a trend trading strategy that will take advantage of retracement of the trend. In this strategy, the trader needs to identify security within a strong trend. Now let’s first get clear with certain basics about fibonacci trading.

It can be defined as a stock with successive highs and pullbacks lesser than 50%. This trading strategy can be used with any market (forex, stocks, options, futures). Fibonacci retracement levels can be used to forecast potential areas of support or resistance, at which time traders can enter the market trying to catch the initial trend when it resumes its course.

The “ fibonacci fan” produces 3 lines set at the main fibonacci retracement numbers, 38.2%, 50.0%, and 61.8%.more often than not the main support line on the “fibonacci fan” is the 61.8%. What is a fibonacci trading strategy? Submit by joy22 time frame h1 or higher.

His father worked in a trading post in the mediterranean, and the young leonardo traveled a lot in pursuit of his studies in mathematics. What is the basis of fibonacci trading? Trades that have a relatively small target.

The fibonacci levels, with the help of its retracements, targets, and extensions, are one of the best tools to use in technical analysis.

The Fibonacci Mystery More Than Just Math Trading

The Fibonacci Mystery More Than Just Math Trading

Best Forex Trading Strategies and Tips in 2019 IG EN

Best Forex Trading Strategies and Tips in 2019 IG EN

Fibonacci Retracement Know When to Enter a Forex Trade

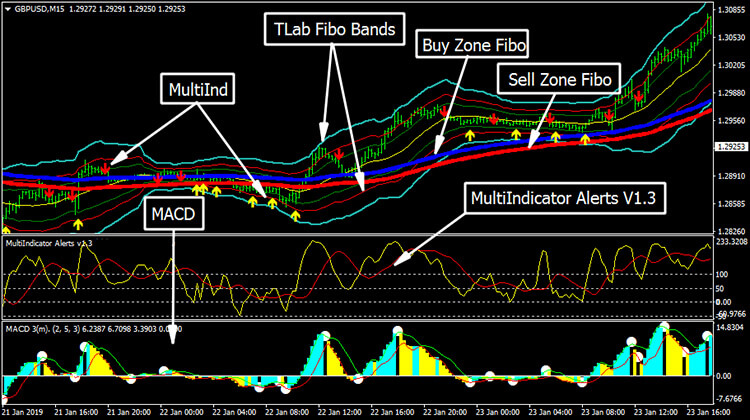

Fibonacci Bands Trading System Forex Download Forex

Fibonacci Bands Trading System Forex Download Forex

Fibonacci Forex Strategie Pdf « Top 3 aplikací s binárními

Fibonacci Forex Strategie Pdf « Top 3 aplikací s binárními

The Fibonacci Mystery More Than Just Math Trading

The Fibonacci Mystery More Than Just Math Trading

GBP/USD Forex Trading Strategy Bullish Towards 38

GBP/USD Forex Trading Strategy Bullish Towards 38

Forex Live 5 min Scalping Fibonacci Retracements

Forex Live 5 min Scalping Fibonacci Retracements

Fibonacci nel Forex i ritracciamenti di Fibonacci • e

Fibonacci nel Forex i ritracciamenti di Fibonacci • e

Beginner's Guide to Fibonacci Forex Trading Strategy

Beginner's Guide to Fibonacci Forex Trading Strategy

learn forex trading forexsystem Fibonacci, Forex system

learn forex trading forexsystem Fibonacci, Forex system

Forex News Fibonacci Trading Strategy Forex Scalping HOW

Forex News Fibonacci Trading Strategy Forex Scalping HOW

Forex Strategy Fibonacci How to trade Forex Strategy

Forex Strategy Fibonacci How to trade Forex Strategy

Forex Fibonacci Indicator FREE Download Forex Fibonacci

Forex Fibonacci Indicator FREE Download Forex Fibonacci

Forex Fibonacci Retracement Trading System Do it Right

Forex Fibonacci Retracement Trading System Do it Right

123 Pattern Fibonacci Breakout Forex Trading Strategy

123 Pattern Fibonacci Breakout Forex Trading Strategy

Beginner's Guide to Fibonacci Forex Trading Strategy

Beginner's Guide to Fibonacci Forex Trading Strategy

FIBONACCI FOREX SCALPER TRADING SYSTEM FOREX Download

FIBONACCI FOREX SCALPER TRADING SYSTEM FOREX Download

0 Comments