Please contact saxo to enquire about the possibility of trading the specific bond offline. We continue to see high levels of electronic trading adoptionacross the entire fixed income market both here in the u.s.

Bond Trading ธนาคารเกียรตินาคิน

Explore the different scenarios that can lead to devaluation of your investment and find out how to balance risks with rewards.

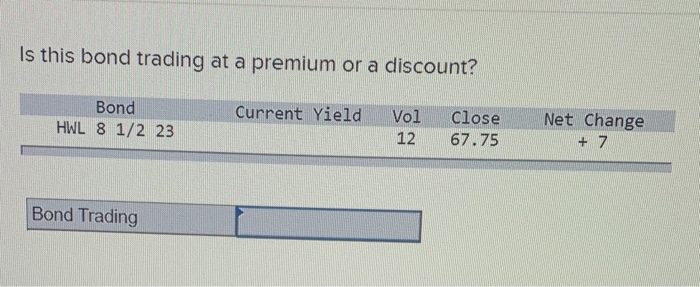

Bond trading. The overall effect of all this bond market activity is the prevailing level of interest rates in an economy. But also globally.is so i don't know is junk bond a term people don't like. Prices can be above par (bond is priced at greater than 100), which is called trading at a premium, or below par (bond is priced at less than 100), which is called trading at a discount.

It was a cultural phenomenon that encompassed this era of “get rich quick with stocks.” in the meantime, the real winners are the lawyers. A bond that’s traded below the market value is said to be trading at a discount while a bond trading for more than it’s face value is trading at a premium. 100% of face value, at par, corresponds to a price of 100;

The bonds range in length from three to 30. A discovery bond covers losses that are discovered while the bond is in. A busy start to the year in bond trading has led to record volatility at electronic marketplaces.

Bonds market data, news, and the latest trading info on us treasuries and government bond markets from around the world. To be successful in bond trading, an investor has to take note of the following key. There are, however, a number of details related to fixed income assets that make bond trading processes.

Citi’s bond trading misses estimates as 2020’s surge weakens by. Investing in bonds part 4: You can write off the losses on the sale but potentially get a better return on the purchase.

January 15, 2021, 8:00 am est updated on january 15, 2021, 10:24 am est 5:09. A bond is a contract between an entity that borrows money and a creditor that lends it to the entity. Bond and bishop dont yet realize that raging bull was more than shady as hell stock picks.

The bond's market price is usually expressed as a percentage of nominal value: Saxo supports 33,000 bonds offline, so there is a good chance that it can be traded offline from our bond desk. With government bonds, also known as sovereign bonds, a national government borrows money to fund its operations.

As with any investment, bond trading has its own set of risks. Bond trading can be short, or long term and allows bond traders to take a position on future interest rate movements while leveraging the security and stability of government treasuries. Bond trading fixed income investment instruments, such as bonds, provide you with an efficient way to diversify your investments with different level of risks and return, while providing regular interest income and potential capital gain.

Bond trading and portfolio management: A bond swap is simply selling one bond and immediately using the proceeds to buy another. The candidate will various techniques and strategies that are applied to generate gains for the company by taking advantage of the market situation.

An order to buy $25,000 face value of bonds issued by gmac with a coupon rate of 5.25%, maturing in 2016, would appear in the nyse system as: Can reduce your tax liability. Corporate bond portfolio management is a very dynamic and continuous process.

Bond dealers and bond investors alter their portfolios in light of changing market conditions to make a profit and/or maximize the return on their portfolios. In this two day training, participants will learn how bonds (treasury bonds, corporate bonds and mortgage bonds) are issued, traded and evaluated. Bonds can be a great way to diversify your investment portfolio, however, they can also be quite complex.

It requires the investors to continuously monitor various sectors of the market, offering an attractive balance between risk and expected return. Key terms regarding the trading of bonds. A type of fidelity bond used to protect a business from losses caused by employees committing acts of fraud.

At the highest level, marketaxess holdings inc. Bond markets move based on the expected change of economic indicators such as growth and inflation, which will determine the bond value to the investor. Put differently, when investors buy bonds from bond issuers, they provide small loans to the issuers.

This bond trading course will teach you how to value bonds and compute the bond yield. When you purchase a bond, you are effectively giving a loan to the bond issuer. A bond is a type of debt instrument issued (sold) by a government, company, corporation, or local authority to raise money for projects and operations.

Bond trading is lower profile than stock trading but it is more important. A type of bond that's been sold by the world bank since 1989 in order to finance its operations. For each of the three categories we will be studying the valuation method, the different type of risks and the particularities of each market.

They will pick bond and bishop’s pockets for whatever they can grab. When investing in bonds, you'll want to understand and use asset allocation. If so, it will be manually traded, but will still appear in the account summary of your account just like any other position.

In many ways, trading bonds is the same as trading stocks or mutual funds.

Government Treasury Bond Trading uabsc

Government Treasury Bond Trading uabsc

Bond trading leading SP500 for continued direction

Bond trading leading SP500 for continued direction

New bond trading platform to help spread risks, Banking

New bond trading platform to help spread risks, Banking

Bond Trading 4 Reasons to be a Bond Trader in 2018

Bond Trading 4 Reasons to be a Bond Trader in 2018

Bond targets forcing a repricing of stock indices 10/03/2018

Bond targets forcing a repricing of stock indices 10/03/2018

What I Look For In A Long Bond Trade.. YouTube

What I Look For In A Long Bond Trade.. YouTube

Jefferies expands risky bondtrading desk with latest hire

Jefferies expands risky bondtrading desk with latest hire

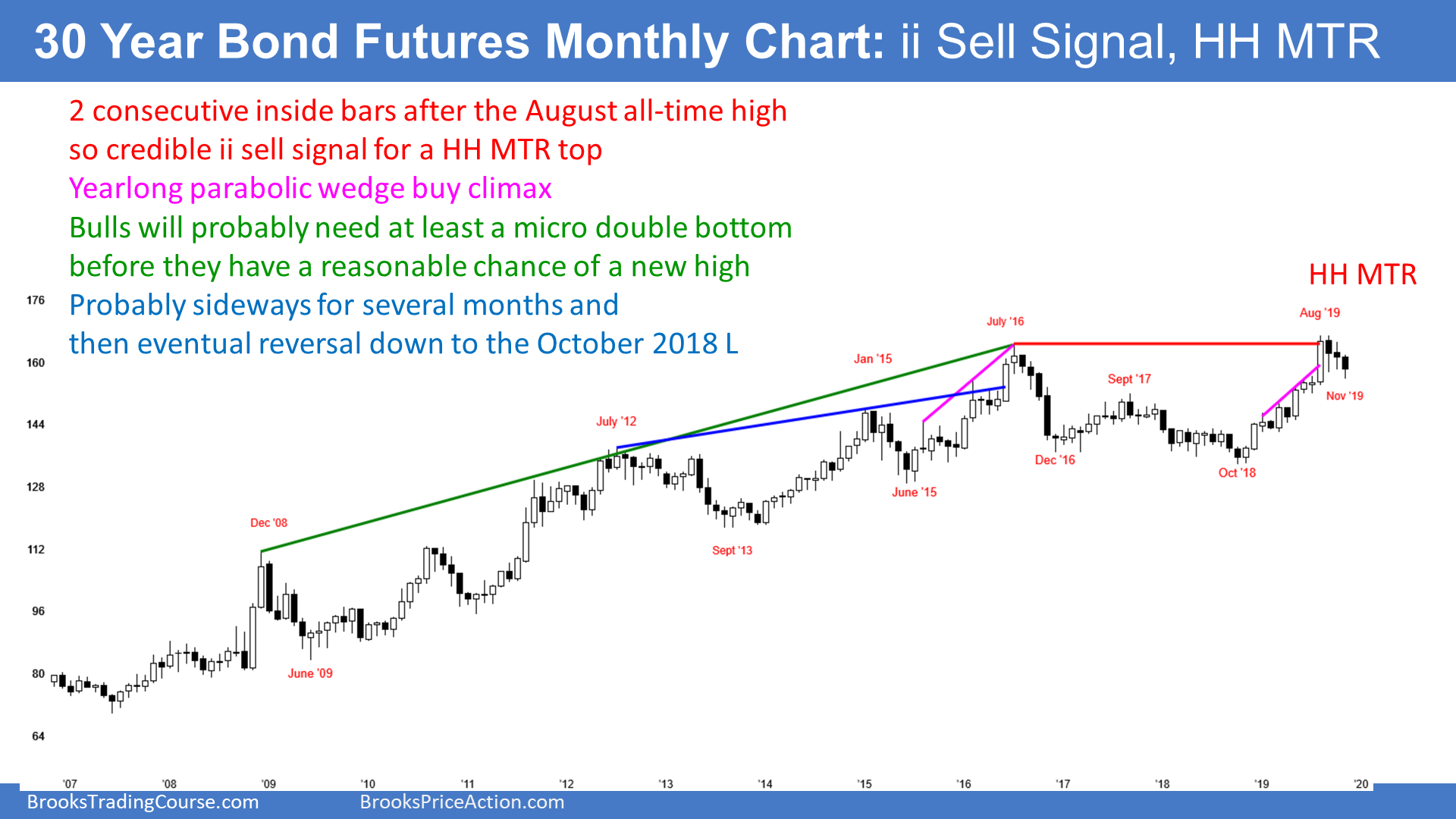

Emini November buy climax at top of yearlong bull channel

Emini November buy climax at top of yearlong bull channel

Why Are Most Corporate Bonds Still Traded on the Phone

Why Are Most Corporate Bonds Still Traded on the Phone

Bond targets forcing a repricing of stock indices 10/03/2018

Bond targets forcing a repricing of stock indices 10/03/2018

/https://www.thestar.com/content/dam/thestar/business/2018/12/14/bond-trading-slumps-for-another-year-at-canadas-big-six-banks/royal_bank_of_canada.jpg) Bond trading slumps for another year at Canada’s big six

Bond trading slumps for another year at Canada’s big six

Trading Bonds How are Bonds Traded?

Trading Bonds How are Bonds Traded?

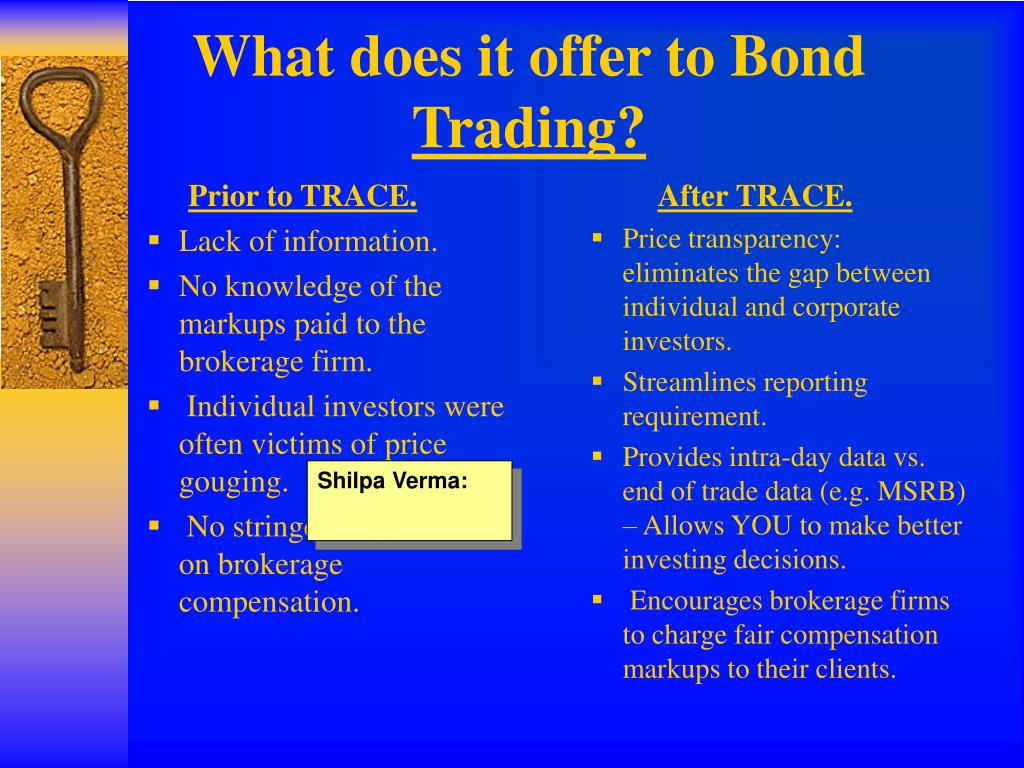

PPT Using The TRACE system for Better Bond Investing

PPT Using The TRACE system for Better Bond Investing

Bond Trading Explained Option Strategies and Technical

Bond Trading Explained Option Strategies and Technical

New Technology and Rules Transform Bond Market The New

New Technology and Rules Transform Bond Market The New

Bond Trading 101 Prices, Maturity, Treasury Bond Futures

Bond Trading 101 Prices, Maturity, Treasury Bond Futures

Solved Is This Bond Trading At A Premium Or A Discount? B

Solved Is This Bond Trading At A Premium Or A Discount? B

0 Comments